International trade can be tricky, and mistakes can happen as you navigate through the process. However, doing a little homework can help you a long way and hopefully steer you clear of the missteps associated with importing from Hong Kong. In the following article we have highlighted the most important aspects to be aware of for a hassle-free import experience.

Trading with Hong Kong

The Hong Kong region is partly autonomous with its own currency as well as its own tax and justice system, however, it is still under China’s control, and is located in southern China. Hong Kong employs the world’s busiest airport for international freight transport and has one of the world’s most active container ports. This is partially due to Hong Kong being a ‘free port’, which means that all goods moving in and out of Hong Kong are exempt from customs control and procedures, making Hong Kong an attractive trading center. Hong Kong has one of the lowest tax rates and one of the simplest tax structures in the world.

Find out more about Hong Kong’s trade policy here, and for more information on trade between Hong Kong and the EU, click here.

FOB or EXW when importing from Hong Kong?

FOB (Free On Board) and EXW (Ex Works) are the two trading terms most commonly used for Hong Kong imports, and imports from overseas in general. FOB covers a port-to-door service where your supplier is responsible for all local costs, ie. transport to the forwarder’s warehouse, handling of the cargo, and export clearance. Meanwhile, when trading on EXW terms, you are responsible for the entire transport door-to-door, including all costs.

Both terms have their pros and cons, and which of the two is most beneficial for you will depend on the specific shipment:

FOB pros include: It is often a bit cheaper than an EXW shipment. This because the supplier in the origin country will often be able to handle the local costs cheaper than your selected forwarder. This is exclusively relevant for LCL shipments, as FCL shipments do not benefit from economies of scale for the local transportation. Also, you do not have to deal with any documentation in the origin country, as this is your supplier’s responsibility. Last but not least, FOB quotes are easy to get a hold of as this is the ‘easy’ part. Collection charges are a bit more tricky and will usually take a bit more time to calculate depending on the specific shipment.

FOB cons: You are exposed to the risk that your supplier suddenly protests to pay the local charges, even though this clearly is their responsibility. Also, your supplier will most likely charge you an extra cost to cover the FOB charges, which will increase your total trading costs.

EXW pros include: You are in charge and have complete control of the shipment and associated costs from beginning to end. Also, you will usually get your products slightly cheaper when dealing on EXW terms, as your supplier will add the local transportation costs to the invoice when dealing on FOB terms–like mentioned above.

EXW cons: It is often the most costly solution, as you alone are responsible for the entire transport process. Also, when trading on EXW terms, you are in charge of export clearance, so you must be assure that your supplier has their export license, if necessary. Moreover, when selecting a forwarder to handle your shipment, you must ensure that they are able to provide you with a door-to-door service and that they can handle the customs clearance process.

Do not forget to assess your options so you can clarify which service is most beneficial for you. Also, it is important to always get the agreement in writing, so there is never any doubt on what terms you have agreed upon.

You can read much more about FOB and EXW and how to choose the right service here.

When all details are in place you can easily search for both FOB and EXW prices from Hong Kong–and from other destinations all over the world using our price calculator.

Sea freight or air freight?

When deciding how to take your goods home, the following two parameters will often influence your choice the most: transit time and price. Importing from Hong Kong by sea will typically take 35-40 days door-door and up to 10 days with air freight–depending on whether you choose a standard or an express service.

Sea freight: FCL or LCL?

For containerized sea freight, you will deal with the terms LCL and FCL, which refers to the different ways you can ship your goods. FCL (Full Container Load) refers to a full container shipment, while LCL (Less than Container Load) indicates a shipment where several importers “share” a container.

To start, the volume and weight of your shipment will determine which of the two options is the most beneficial for you. As a rule of thumb, all shipments under 15m3 are most relevant to ship as break bulk (LCL), whereas shipments of 15m3 or greater conveniently can be sent in one or more full containers (FCL).

There are three different types of containers when importing from Hong Kong: 20 foot, 40 foot, and 40 foot HQ.

A 20 foot container has a maximum weight capacity of 24,000 kg and stores approximately 30 m3.

A 40 foot container has a maximum weight capacity of 26,000 kg and stores approximately 60 m3.

A 40 foot HQ container has a maximum weight capacity of 28.500 kg and stores approximately 70 m3.

For LCL (break bulk), the price is calculated on the basis of volume (cubic meter), which refers to how much space the goods take up in the container. Because the weight restriction for sea freight is very high (1000kg / cbm), the weight typically will not influence the price unless, of course, you have very heavy cargo.

Air freight

On the contrary, the price of air freight is calculated based on the total weight of your shipment. Therefore, the heavier the goods, the more expensive.

More specifically the price for standard air freight is determined based on the ‘volumetric weight’, perhaps better known as ‘chargeable weight’.

This means, in practice, that the price is calculated on the basis of a ‘Dimensional Weight Factor’ or DIM factor, which is based on the aircraft’s loading capacity, and has been determined in advance by the airline to charge appropriate costs for goods with light density.

Normally, the DIM factor corresponds to 166.67 kilograms per cubic meter, and

this basically means that for each cubic meter of goods you are importing you will be charged for 167 kg, even if the actual weight of your shipment is only 50 kg. If your cubic meter weighs 250 kg you will, of course, pay for 250 kg and not 167 kg.

With that, when comparing the two modes of transport, sea freight will often have the advantage price-wise, and it goes without saying that the price difference is big for large/heavy shipments, and small for small/lighter shipments. But for very small/light shipments air freight will typically be the cheapest solution.

Due to this, it can be useful to look into both services when importing from Hong Kong in order to know when sea freight is the better solution, and when choosing air freight can prove to be most beneficial. Find prices for sea and air freight via our online price calculator here.

Price Examples

FOB Hong Kong – London

3,3 m3 / 830kg – Sea freight

GBP 432

FOB Hong Kong – Manchester

20 foot container – Sea freight

GBP 2.185

FOB Hong Kong – Southampton

12 m3 / 6.200kg – Sea freight

GBP 1.080

EXW Hong Kong – Cambridge

0,8 m3 / 54kg – Air freight

GBP 976

EORI Registration

When importing from Hong Kong and other countries outside of the EU, you have to register for an EORI number. The EORI number is required in order to trade goods with 3rd countries (countries outside the EU). If you do not already have an EORI number, it will usually take 3 working days to get one.

If you are looking to import restricted goods, like firearms, you will also have to register for an import licence.

For more information on the important aspects of importing, please read this.

Duty

When importing goods from Hong Kong, or any countries outside of the EU, you are required to declare your imports to customs (this is usually done by a third party, ie. a freight forwarder or courier), and to pay duty on the goods. The amount will depend on the type of cargo and where in the world you are importing from. Therefore, in order to calculate the duty charges, you need to know the product code(s) of your goods.

To find the correct product code and to learn more about import duties, you will benefit from the following link and search tool: www.gov.uk/trade-tariff.

Once you know the product code, you can also search the TARIC database, which can provide you with information on various customs arrangements, including any tariff reductions and duty exemptions.

Importing from Hong Kong with Transporteca

When you have decided how you would like to ship your goods home, the next step is to select a relevant forwarder to handle the transportation for you.

But in fact it can often be a challenge to get the total shipping costs up front, which unfortunately means that some importers end up having to pay unexpected costs before they can get their goods delivered–which naturally results in unsatisfying import experiences.

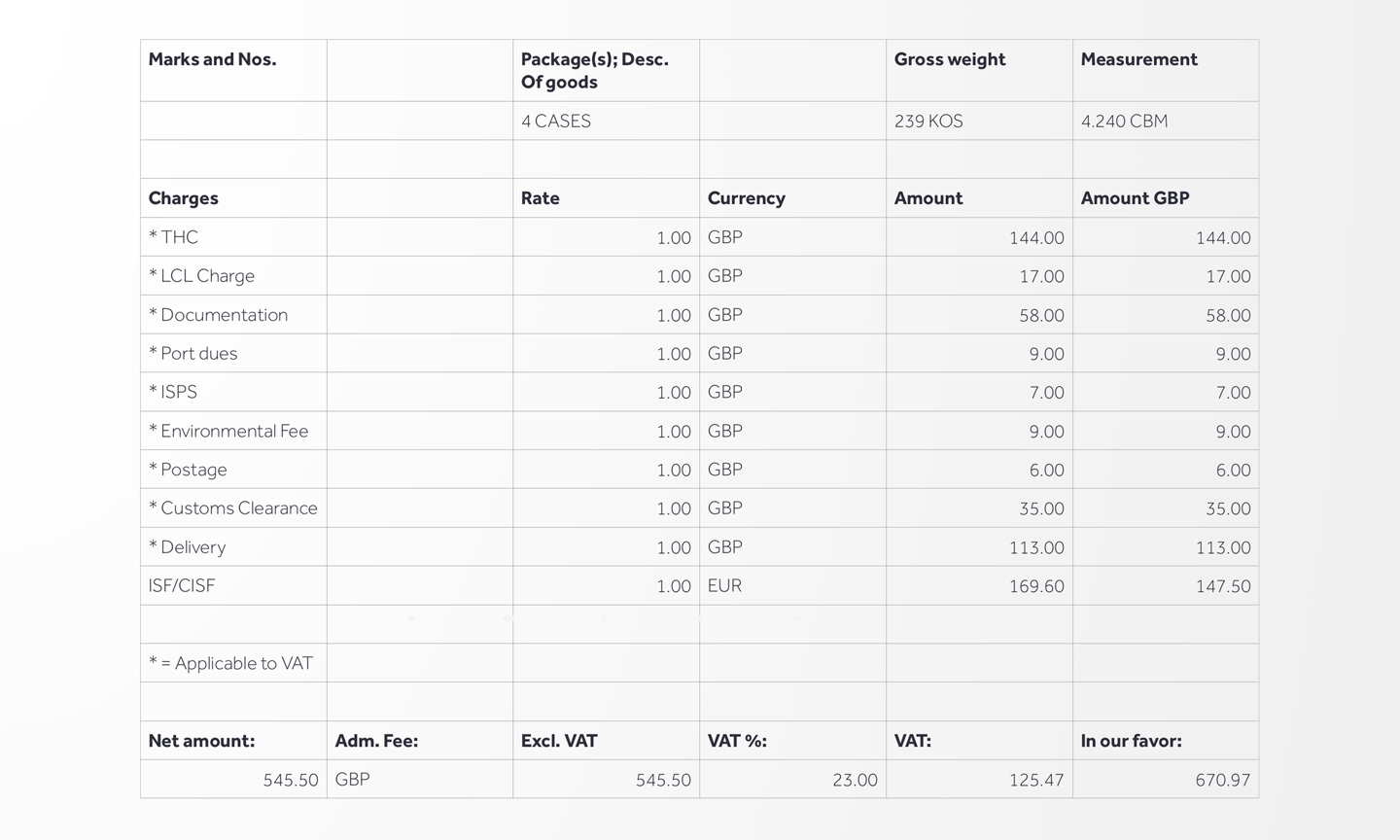

For instance, take a look at the example below of an actual invoice from a freight forwarder. Can you figure out what the the individual fees cover?

To avoid this, you always get an all-in price when you book your transport via Transporteca. We guarantee that there will be no unexpected charges or additional costs, provided the correct cargo details were specified during your booking. For example, if you have booked a pickup of 1m3, but the goods in fact are 3m3, then there will be a charge for the additional costs. Alternatively, should you have booked a freight of 3m3, but it is only 1m3, you will then get the difference refunded. However, it is always preferred that you provide the exact volume and weight of your shipment, your supplier can easily give you this information. This way, no one has to bother with extra bills or refunds, and we make sure the right amount of space is reserved for you in the container or on the aircraft.

Give our online price calculator and booking portal a try here, and if you find what you are looking for, you can always book directly online, and soon after an email will automatically be sent to the UK freight forwarder and to your supplier in Hong Kong so that they can easily agree on the details for pickup (EXW) or delivery to the warehouse (FOB)–depending on which service you have booked.

Should you have any questions regarding importing from Hong Kong, please get in touch. We are ready to answer your questions at [email protected] or +44 20 3769 6586.