FOB or EXW? For many new importers incoterms can be overwhelming and confusing, as there are many things to be aware of: How does it work, who can I trust, what are incoterms, and which is the best solution for me? With this article we aim to introduce you to the most common incoterms, FOB and EXW, which are essential to be familiar with when you are importing from overseas. Knowing your incoterms can help you avoid unexpected charges.

International trading terms

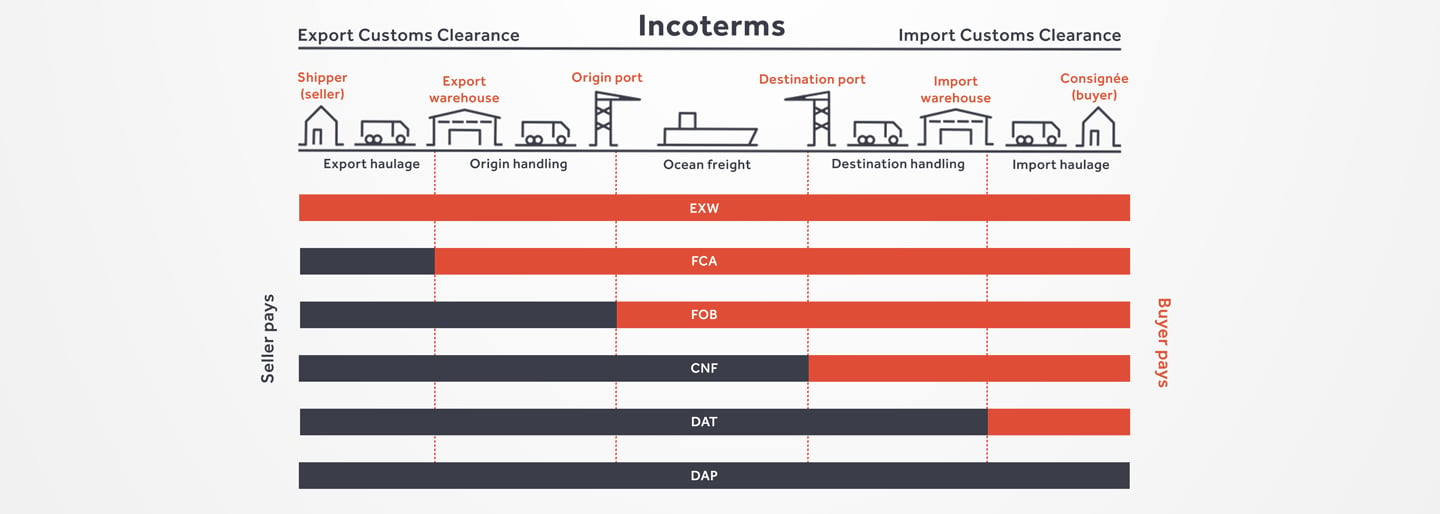

To avoid misunderstanding, The International Chamber of Commerce has developed a set of trading conditions that are globally recognized today. The trading terms, also known as incoterms, determine when the ownership of your products shift from your supplier to you. Along with the ownership, the responsibility for loss and damages, and the transportation costs shift. When buying a product from a local store, this shift is less important, but when you buy from a manufacturer from across the globe–with several weeks of transportation between you–it is very important to know exactly when the ownership and responsibility of the product shifts from your supplier to you.

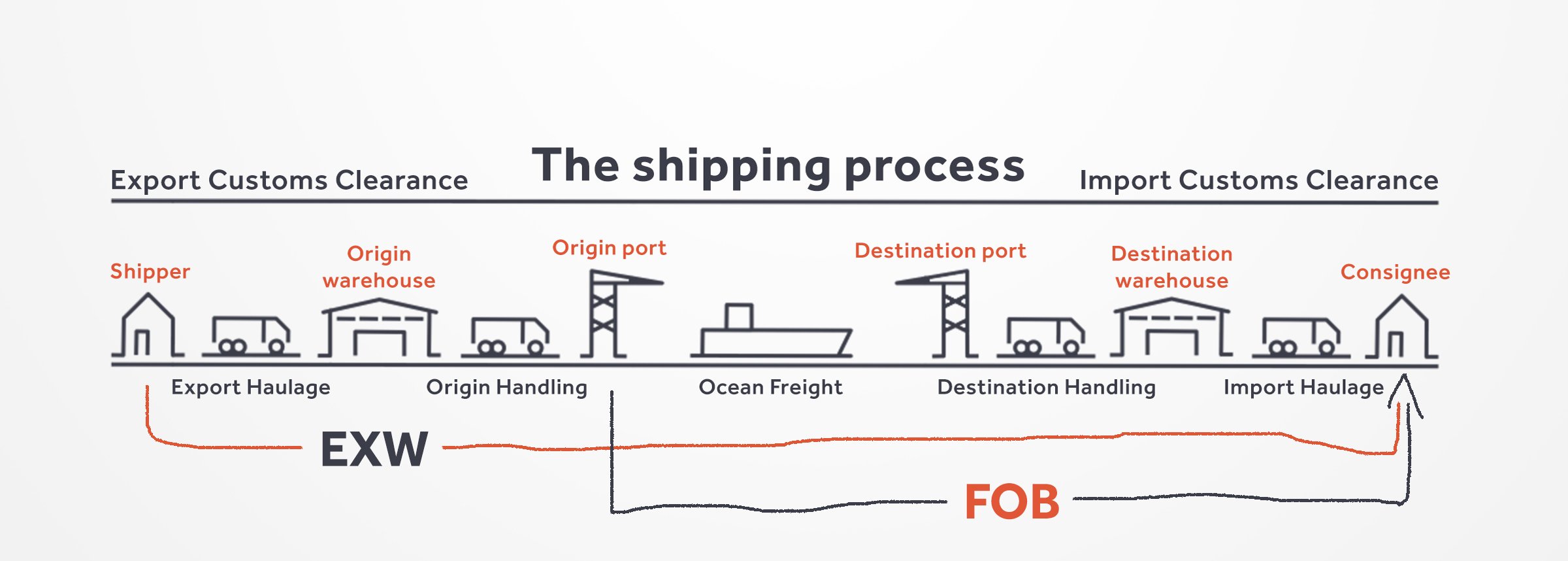

It can be illustrated as follows: Imagine that your supplier holds the responsibility and costs of the blue part of the transport process, and likewise you are responsible for the red part. When this shift of ownership and responsibility happens will depend on which trading terms you and your supplier have agreed upon.

Free on Board

FOB is an abbreviation of ‘Free On Board’, and is a port-to-door shipment. This means that when you trade on FOB terms, your supplier is responsible for all local charges, which include transport to the port, handling of the cargo, and customs clearance at origin. This also means that you have to find a freight forwarder to take over your shipment and carry out the freight when your goods board the ship (or aircraft) for the UK. As soon as your goods are aboard the ship or airplane, the transport responsibility and cost shifts from your supplier to you as importer.

As mentioned, you are responsible for finding a forwarder to carry out the transportation of your goods, but all local charges in the origin country will be billed directly to your supplier/manufacturer. Your supplier might try to influence your forwarder choice in order to lower local costs, but keep in mind that the decision is yours alone. When buying your products on FOB terms your supplier will include the local charges (sometimes + a buffer) to your cost, so they do not risk losing money.

Ex Works

EXW is short for ‘Ex Works’ and refers to a door-to-door shipment. If you trade on EXW terms, you are responsible for the entire transport process, meaning it is your responsibility to arrange transportation from your supplier’s door to your address in the UK. Therefore, when you select a forwarder to handle the transport for you, make sure that the transport solution includes customs clearance in both the origin country and in the UK.

Both trading terms are used only for imports and have several similarities. However, the difference between the two is clear: Using EXW, you are responsible for all costs associated with your transport to the UK, whereas, with an FOB agreement, you are only accountable for the costs that come after your goods have boarded the ship (or aircraft), as your supplier is responsible for the local costs in the given origin country.

For more information about incoterms, have a look here.

FOB Exemplified

Your supplier resides in Lonavala, India, which is about 80 km southeast of Mumbai. Your supplier offers to take care of the local costs in India and you agree to purchase the goods ‘FOB Mumbai’.

In practice, this means that your supplier is responsible for your shipment from their address in Lonavala to the port of Mumbai, plus the associated costs: handling of the cargo and customs clearance. After your goods have passed the ship’s rail in Mumbai, your nominated freight forwarder will take over both ownership, cost, responsibility of the shipment, and will arrange the remaining freight to your address in the UK.

EXW Exemplified

Your supplier is still based in Lonavala, but is not willing to bear the local costs associated with the transportation. Therefore, you agree to buy your goods ‘EXW Lonavala’, which means that you hold the responsibility for all costs associated with the transportation, including pick-up at your supplier’s door and export clearance. This means that your chosen freight forwarder handles everything relating to your import from India to the UK.

Which trading option is the most beneficial for me – FOB or EXW?

There is no definitive answer to this. Both incoterms have their pros and cons depending on your specific shipment. Below we have listed the most remarkable advantages and disadvantages for the shipping terms FOB and EXW:

FOB advantages

There is often money to be saved by trading on FOB terms, as your supplier can usually get the goods delivered to the port and customs-cleared at a lower price than your freight forwarder can. Thus, the total cost of the complete transportation process will typically be lower for a FOB shipment than an EXW shipment, for both you and your supplier. This is most pronounced for LCL shipments, as there are no economies of scale for the transportation from the supplier to the port for FCL.

You do not have to worry about documentation in the origin country (export clearance) as this is the supplier’s responsibility.

Quotes are fast and easy to collect from most UK forwarders.

FOB disadvantages

You can end up in a situation where your supplier refuses to pay the local costs even though this has been agreed upon.

Your supplier might charge you a ‘buffer’ related to the local charges, which will increase the total cost of your shipment.

EXW advantages

Goods bought on EXW terms will often be slightly cheaper than products bought on FOB terms, as the supplier will include the costs of transport to the port, handling of the goods, and customs clearance to a FOB trade.

Full control of the cargo and the transportation cost from start to finish.

EXW disadvantages

You will often get a cheaper product when buying EXW, but your transportation costs will increase, as you alone are responsible for the entire transport from your supplier’s door to your door in the UK.

You are in charge of export clearance, and therefore you must ensure that your supplier is licensed to export (if needed).

When searching for a freight forwarder, you have to find someone who offers both a door-to-door service (EXW) and offers to handle the process of customs clearance.

Know your total landed cost

In order to know which incoterm is the better option for you, it is always a good idea to look into the pros and cons of your options before you commit to one or the other. The way to do this is to figure out your total landed cost. The landed cost refers to the total cost of the product once it has arrived at your door. The landed cost includes the cost of the product, transportation costs, insurance and taxes and duties, i.e. all costs associated with importing your goods.

Not all of these components are present for every shipment – this varies depending on, for example, the origin country and which incoterms that have been agreed upon – but all present components must be considered part of the total landed cost.

The total landed cost will give you a true overview of all expenditures and this way you can easily calculate which incoterm will be the better option for you in regards to producing the most revenue. Therefore, take some time to do the math for both a FOB and an EXW shipment and once you know the total landed cost for them both, you will know which option is most beneficial for you.

Example of landed cost

Below we have listed two examples of total landed cost – one for FOB and one for EXW:

Cargo details:

3.2 cbm / 285 kg of garments

Delivery in London

FOB Mumbai costs:

Cost of product: GBP 8.640

Cost of transportation: GBP 733

Cost of duties (12%): GBP 1.125

Total landed cost: GBP 10.498

EXW Lonavala cost:

Cost of product: GBP: 8.450

Cost of transportation: GBP 1.034

Cost of duties (12%): GBP 1.138

Total landed cost: GBP 10.622

Based on the above example, for a scenario like this, it would probably be a better solution for you to import your goods on FOB terms.

Ready to take on your forthcoming shipments?

We hope the posts has offered some clarification in regards to the two incoterms, FOB and EXW. As a last advice, do not forget to clarify the terms and conditions right away when you start your negotiation, and to get everything in writing, so there is never any doubt on what has been agreed upon.

Transporteca offers both FOB and EXW rates on both sea and air freight from various destinations across the world. If you are unsure about which is more beneficial for you, or you have any further questions, please do not hesitate to get in touch, we are here to help: [email protected] or +44 20 3769 6586.